Credit Repair isn’t the easiest journey; whether you’re doing it yourself or hiring a professional. It is levels and patience in this game. Many people wreck their credit and expect it to take a couple of days to bounce back. That is not the case. Whenever one is late 30 days on a payment ,it can cost up to 100 point deductions. Creditors notify the reporting agencies: TransUnion, Experian, Equifax and any others reporting your personal information.

Your late payments, collections, repossessions, etc. can stay on your report for 7 years. That is a long time. When you go to apply for a mortgage or other huge purchases, lenders will evaluate your credit report. Any negative findings can hurt your chances of obtaining new lines of credit. It’s important to evaluate your credit monthly and stay on top of all your current financial obligations.

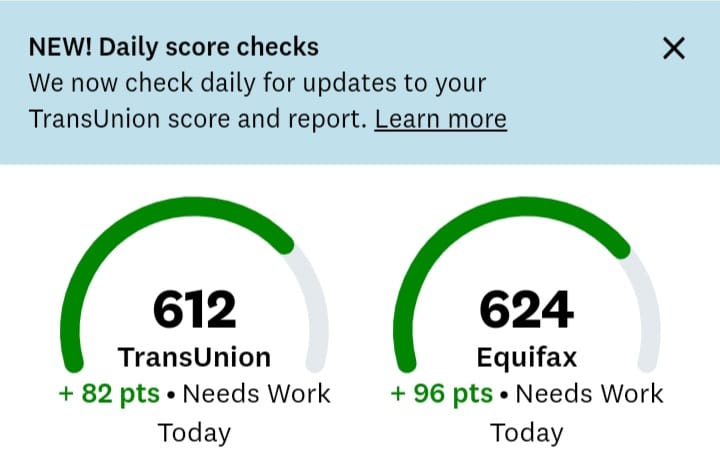

Step 1 : Analyze your report– You can use a FREE site like CreditKarma. Keep in mind, it may not give you the most accurate score or details of your report.

Sites to check your report :

https://www.annualcreditreport.com– FREE

https://member.identityiq.com/Mobile/get-all-your-reports-now.aspx?offercode=431133sa&mtid=765959 Monthly subscriptions, identity protection and monitoring

https://www.smartcredit.com/?PID=88613 Monthly subscriptions, identity protection and monitoring

Step 2: Look for inaccurate info( our software takes care of all the hard work).

You are to scan your report thoroughly for anything inaccurate, negative, outdated,etc. You may notice your name misspelled or wrong addresses. These are reasons to dispute. You might also notice all 3 Bureaus reporting the wrong info on your accounts.

Step 3 :Send out dispute( our letters are designed to be aggressive and take care of all inaccurate and negative info. When it comes to letters, keep it simple! No need to use templates. The simple the letter; the better chnces to getting items removed.

Step 4: Deletions

This is the fun part! After sending out dispute letters, it will take about 30 dats for Bureaus to respond. If they don’t respond in timely manner, the accounts get deleted. This could cause either an increase or decrease in your scores.

Step 5: Time to rebuild. Add new lines of credit. Check out my tools to help rebuild your scores!

https://www.self.inc/?utm_source=refer-a-friend&utm_medium=referral

Check out my website for other credit building tools https://creolefinancialsllc.net/

Bonus: Have a new mindset. Prioritize bills. Pay on time, don’t take out too much credit, pay off debt and live within your means. If you get a clean start, work hard to stay on tract. You are the master of your finances!